Can't archive ATM

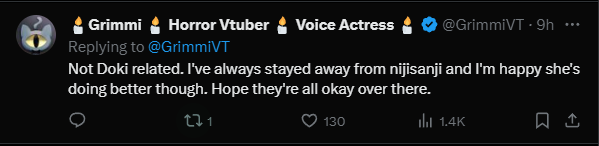

Grimmi got into Niji and is now having second thoughts?

Edit:

I can believe it

archive

Can't archive ATM

Grimmi got into Niji and is now having second thoughts?

Edit:

If even a fraction of the things that have come out are true, Grimmi would be a prime target for some bad people in that corpo.Grimmi got into Niji and is now having second thoughts?

Can't archive ATM

Grimmi got into Niji and is now having second thoughts?

Can't archive ATM

Grimmi got into Niji and is now having second thoughts?

Edit:

If even a fraction of the things that have come out are true, Grimmi would be a prime target for some bad people in that corpo.

Good to see that the man is aware of the competition, not only domestic, but also internationally.the popularity of overseas anime has been rising. "The soil is in place to make it easier for VTubers with anime-looking avatars to be accepted," he said, adding that the acquisition of overseas users has had an impact on the further expansion of the market.

In addition to Cover himself developing VTubers active in English-speaking countries, the VTuber market is expanding worldwide as "new content from Japan", with companies starting VTuber businesses in North America.

This concerns the estimated value of the entire domestic Vtuber business. It's quite a dramatic growth in just 3 years, and it is expected to grow even bigger in the future when you factor in the global market:Looking at the domestic market, according to a survey by the Yano Research Institute, the VTuber market size was 14 billion yen (94 million USD) in FY2020, but it is expected to be about 80 billion yen (530 Million USD) in FY2023.

It also has an interesting note about the market values of both Cover and Anycolor:Looking globally, according to Global Information's analysis of the VTuber world market, the forecast for the VTuber world market size in 2021 was about 242.1 billion yen (1.6 Billion! USD). This is expected to expand to approximately 2.57 trillion yen by 2028, more than tenfold increase. Capturing this 2.5 trillion yen (16.7 Billion USD) global market becomes the goal for leading VTuber business companies like Cover.

One can see that the Market cap of Cover and Anykara is quite close, but also that Anycolor has very significantly more sales than Cover. Not the biggest shocker, but still the only 2 who could rival sales numbers of the top Holo Talents are Kuzuha and Kanae.The market capitalization of the cover is 163.6 billion yen (as of December 18, 2023). Sales have grown 14 times in four years, from 1.4 billion yen in the fiscal year ended March 2020 to approximately 20.45 billion yen in the fiscal year ending March 2023.

ANYCOLOR has a market capitalization of 192.2 billion yen (as of December 18, 2023), sales for the fiscal year ending April 2023 are expected to be 25.3 billion yen, and sales for the fiscal year ending April 2024 are expected to be 33 billion yen, including estimates based on public information.

The fanbase is getting more diverse and has a bigger age-range, which opens up new opportunities for collabs with brands that don't just target tweens.This thriving market, popular among young people in Japan and abroad, particularly Gen Z, has expanded its appeal to various age groups, including those in their 10s, 20s, 30s, and 40s. With a multi-generational fan base, collaborations and tie-ups with companies are also increasing. The virtual nature of VTubers makes them flexible for companies in terms of costumes and staging.

As expected, merch and Sponsorships are now the main drivers of Vtuber revenue. I am actually kinda surprised that in 2021 donations and Stream-earnings were still the biggest money-maker.of the approximately 5.7 billion yen in sales in the fiscal year ended March 2021, 46% were revenues from distribution/content, 14.2% from live/events, 32.3% from merchandising.

As of the second quarter of the fiscal year ending March 2024, merchandising and licensing/tie-ups will account for 58.4%, or about 15.5 billion yen, of the approximately 26.7 billion yen in the sales forecast. Distribution/content has dropped significantly to 28.1%, and it is no longer the main revenue of the VTuber business.

More game collabs incoming I guess. I like that the article uses the example of Sanrio, since Yagoo used to work there for a bunch of years. He's basically a pro at this IP licensing business.Mr. Tanigo suggests that the earnings structure of VTubers is evolving towards that of an IP company, akin to Sanrio. VTubers are increasingly viewed as character IPs. or example, he said that he expects the release of games featuring hololive characters (they have already appeared in fanfic games that meet the guidelines).

I like the slight shade here, Nijitalents are just what sticks to the wall, but Holo Talents are all EliteVTuber production ventures can be approached in several ways, and the contrast between the publicly listed Cover Corp and ANYCOLOR is a prime example. Cover's approach can be summarized as "elite-focused." They select their talent candidates through rigorous auditions and spend a relatively long period on education and training before debut.

By ensuring high quality in their talents, they can achieve a higher number of subscribers per channel, attract a large fan base, and increase annual revenue per person.

A whole section of the article is how important Fan-made content like clips or similar are to the brand. They seem to realize that its basically free advertising, and use Marines songs going viral on Tiktok as a good thing as it spreads the name of Hololive and its talent around, even if they don't directly earn money from it.It also touches on the expansion of UGC (User Generated Content). A typical example is a "clipped video" in which the highlight is cut out of the live streaming video and edited such as subtitles, and there are also support ads for fans to advertise, posts of videos of dancing and singing, and derivative works including self-made games.

Spontaneous clipping videos by fans have already become large-scale, and there are 121 channels dedicated to clipping videos targeting hololive. The channel has a total of 10.3 million subscribers and 6.86 billion views.

If you had more than just 1 (UNO) streamer in the EU timezone, maybe, juuuust maybe, yall would have a better market share there too bozos.facing intense competition in the global market, according to Mr. Tanigou. The market is already expanding, especially in North America and Southeast Asia, and there is room for further expansion in Europe, where time differences make it difficult to watch live streams.

Not a surprise, but probably more EN gens to comeWhile anyone can start as a VTuber, achieving high quality requires technological investment, which serves as a significant barrier to entry, giving Cover a competitive edge.

Cover has already attracted a large number of overseas users with talents who operate in Japanese, and has also developed groups like "Hololive EN" that target overseas audiences. Thus, connections with the international market are already established, and efforts are underway to expand.

Yagoo is proud of Raden and rejects the notion that all vtubers are cute and idol-like, more important than that are unique personalities and interests that tap into new marketsDuring the Q&A session, a question about the widely accepted definition of a VTuber was raised. Mr. Tanigou gently refuted the premise of needing a broadly accepted definition, stating, "Is it necessary to have a definition that is widely accepted?" He highlighted the debut of a talent with deep artistic and sculptural skills, Raden (Juu Karasutei Raden), who was unlike any before. This success in integrating new communities and gaining new popularity was attributed to meeting previously unmet demands, emphasizing the importance of individuality over a one-size-fits-all approach.

Yagoo confirming that they will not kill anyone just because of poor numbers and that they space out debuts to provide better support.In response to the question of whether they would end the activities of VTubers who do not become popular, the answer was, "I think of us as a company that does not discontinue services." "We are not a high-output, high-failure model. Debuting many at once would reduce the opportunities for promotion. We plan to space out debuts to address each one individually."

There will be no AI vtubers in Hololive. They are convinced that the fans need a real person with real dreams to support, something an AI just cannot provide.Regarding the possibility of AI-generated VTubers in the future, Mr. Tanigou, firmly stated there is no possibility for it. He explained that the VTuber business thrives on the structure of fans supporting the talents' goals, something an AI-generated character cannot fulfill. "The real need is for a real person to spread their wings, and I thought that being seen as a real person was required."

panora.tokyo

panora.tokyo

Comparing the Vtuber industry growing internationally with how Airbnb and Uber also became international, interesting angle there yagooMr. Tanigou shared his personal opinion, noting that the VTuber market is a rare instance of a phenomenon originating from Japan, similar to how Airbnb and Uber started in the United States and then expanded to Japan and beyond.

Just expanding a bit more on the point above about going into international markets. They are also aware of local demands and the need to adapt, no 1-fits all approach when expanding into new regions.What I mean to say is, there are regions where VTubers have penetrated and others where they haven't yet. For example, in the United States, they are becoming quite popular, and fans of anime and games are well aware of them. However, in the EU, including France, which is known for its large fanbase of anime and manga, VTubers haven't quite taken off yet.

I think a big part of this is the issue of time zones. Content that is broadcast in American time zones isn't as enjoyable in real-time for those in the EU. Since this content is about fans interacting and communicating with each other while watching the same stream, not being able to enjoy that becomes a problem.

In that sense, there's still room for VTubers to grow in each country. VTubers aren't just anime-look characters; for example, the Korean PLAVE I mentioned earlier is a webtoon VTuber, which meets the local needs right there. I think VTubers that cater to each country's specific needs will start to emerge.

Even though we talk about licensing out, for now, it's limited to short-term collaborations with convenience stores, for example. But if it expands to games that exclusively feature these IPs or to animation content, I think it could broaden further.For instance, there are certainly people who watch anime but don't watch VTuber streams. If anime can take on a role in acquiring a broader fanbase and increasing brand value, and if monetization through games can be pursued more than before, I believe there's a possibility for that (tenfold market growth in seven years) to happen

In 2023, hololive productions increased by +13.7% year-on-year, and Nijisanji projects also saw a slight increase of +1.9%.

Vspo! Brave Group saw the highest year-on-year growth of +32.4% among major companies.

On the other hand, Nanashinku has decreased significantly by -29.9% year-on-year, and Nori Pro has decreased by -48% year-on-year. In both cases, members graduated or retired one after another.

Since the beginning of 2022, NIJISANJI EN has increased its market share significantly, and hololive (hololive EN, hololive Indonesia, and holostars EN) has been gradually losing share, but with the debut of hololive English -Advent- in July 2023, the market share has changed completely, and from August onward, hololive has a 50% market share. It has exceeded the trend.

On the other hand, Nijisanji has been greatly affected by the graduation of NIJISANJI EN's Mista Rias, and it can be said that it has clearly lost market share since September.

In addition, overseas companies other than Holo Niji (Phase-Connect, Idol, etc.) are increasing their market share, and it will be interesting to see whether a third pole will be formed.

Hololive (JP) is of course at the center of hololive productions, and that trend hasn't changed, but hololive English has significantly increased viewing time since Q3 2023 with the debut of Advent.

On the other hand, the male brand HOLOSTARS (JP・EN) has not yet made its presence felt, and it will be necessary to grow in the future.

The Nijisanji Project has a total of 24 students, 18 JPs and 6 ENs, making their debuts at the same pace as 24 in 2022 (8 JPs and 16 ENs) and 20 in 2021 (5 JPs and 15 ENs), but 17 people graduated or suspended from the program, up from 12 in 2022. In 2024, it has already been revealed that six students will graduate and end their activities.

While total broadcast time is +13% year-over-year, the average viewership has decreased by about 10%, which can also be said to be dispersed due to the increase in Vtubers.

As you can see by comparing it to hololive's graph, Nijisanji's total viewing time stands out in Q3. This is largely due to the impact of Nijisanji Koshien, but considering Q3, it can be said that Nijisanji is doing well.

However, NIJISANJI EN has continued to decline since peaking in Q2~Q3 2022, and this trend is expected to continue due to the continued graduation from NIJISANJI EN.

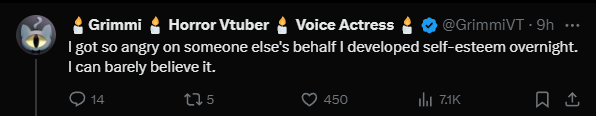

out of pure rage.

out of pure rage.It is NoriProCan anyore identify who the pink corpo here is?

Unironicaly a cult victim plz be nice to herdoesnt she have terminal sad-girl? wouldnt be suprised if it was something entirely unrelated to current events

I confess, I'm a bunch of tiny latinos in a trenchcoat

- Many spics @braindoko

Someone finally made a clickbait video if anyone wants to see the ridiculous physics on roach-hag

Its funny that she got the anime mom death flag braid though, fits her

I am ready for either fuwawa or mococo toout of pure rage.