Thought I'd share this slice of foot-foggotry autism

"If you are born dumb, then you will grow up dumb!"Enna Alouette

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

General Vtuber Discussion (V1)

- Thread starter The Proctor

- Start date

- Status

- Not open for further replies.

thhrang

Punished Autism Extraordinaire

Early Adopter

Ward Security

♥Realticule's Husbando♥

Joined:

Sep 13, 2022

Thought I'd share this slice of foot-foggotry autism

Krampus is a known insane f&ggot, by the way. He schizoposts in her chat often.

Mako painting 40k minatures

thhrang

Punished Autism Extraordinaire

Early Adopter

Ward Security

♥Realticule's Husbando♥

Joined:

Sep 13, 2022

Folks, things like this is why women's suffrage should have been repealed 100 years ago.

How many more moldy people until we get clones of Reticules trying to fix these girls

Autism. Absolute. Pure. Autism.

All you need to know.... Not pure autism, there's potential body mutilation and a slew of fake hormones and meds

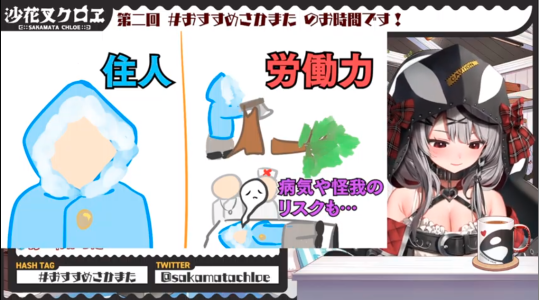

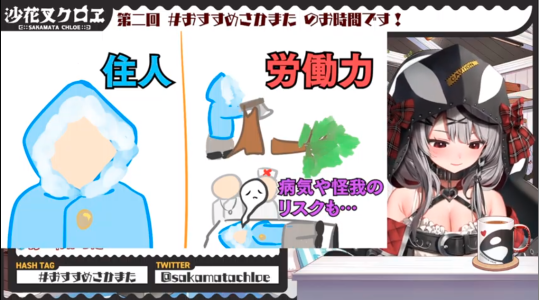

Sakamata has a recurring schedule slot where she recommends a game to her viewers. (Actually this may only be the second time she's used this slot.) The previous recommendation was probably Slay the Spire, as she definitely played it before her first stream, and from what I could understand she explained it well enough.

Today's recommendation is Frostpunk. Unexpected choice. Out of the HoloJPs only Botan streamed it once or twice.

She even prepared a slideshow to explain the premise.

I forgot to mention that Kronii finished the first scenario and the Last Autumn DLC. She'd played the base game before but played the DLC blind.

Sakamata played for slightly over an hour. I think Frostpunk needs a longer stream to pitch it, as this was before she could feel the resource pinch and she didn't get any amputees or deaths. She was more ruthless than the lion or self-proclaimed narcissist clock, so I'd like to see more.

Today's recommendation is Frostpunk. Unexpected choice. Out of the HoloJPs only Botan streamed it once or twice.

She even prepared a slideshow to explain the premise.

@Clem the GemI've had this game for a while now but never got round to playing it (as with many Steam purchases...)

I think I'll give this a watch later to see what I'm missing out on.

I forgot to mention that Kronii finished the first scenario and the Last Autumn DLC. She'd played the base game before but played the DLC blind.

Sakamata played for slightly over an hour. I think Frostpunk needs a longer stream to pitch it, as this was before she could feel the resource pinch and she didn't get any amputees or deaths. She was more ruthless than the lion or self-proclaimed narcissist clock, so I'd like to see more.

Last edited:

I wonder which reasons it is she's gone AWOL for so long now and too lazy to simply tweet or member post.Someone on the homeland posted what ina has been up to (link) TLDR playing Lost Ark.

Isn't it known that grinding in MMOs is a symptom of mental derangement? Pretty consistent with her reasons for taking a break to be honest.

People being upset their oshi is playing games during her break, not posting anything on her work account during her break, really need to take their meds.

Sakamata has a recurring schedule slot where she recommends a game to her viewers. (Actually this may only be the second time she used this slot.) The previous recommendation was probably Slay the Spire, as she definitely played it before her first stream, and from what I could understand she explained it well enough.

Today's recommendation is Frostpunk. Unexpected choice. Out of the HoloJPs only Botan streamed it once or twice.

She even prepared a slideshow to explain the premise.

View attachment 7623

I've had this game for a while now but never got round to playing it (as with many Steam purchases...)

I think I'll give this a watch later to see what I'm missing out on.

She put you up to this.Pls unsub from pippa

With our autism combined our children would be a new breed of human, one that is super intelligent, an ubermensch to lead the white race to salvation.

our children

She said that Kiara needs to pay reparations for her ancestors.Zaion debut 2.0 is hidden btw, sis she said something else other than the jew references?

(She briefly sperged about her love for ROM hacks)

Its weird, because her tax-person did manage to have kiaras travels to the maledives and Korea written off because she streamed a certain amount while she was there.Tax sperging below:

I don't know how much I'd agree with Kiara's tax man saying that her games aren't write offs, it is pretty easy to argue that they can be except for one potential issue.

The tl;dr sperging for why: If something you use is used mostly for business use (at least over 50%) it is a write-off up to the percentage of what you paid vs what is used in your business. This is how people can calculate wear and tear on your car (aka depreciation) and gas. I wonder if Kiara is just badly explaining her situation or something, which wouldn't shock me.

So in this case I'd argue that if Kiara plays a game for 4 hours on stream, easily provable via archived vods, and has 5 hours played on Steam (which is easily trackable on the client) then 80% of that should count for the year it was purchased. That's how I'd probably explain it if I had to explain this to the IRS. because this game only exists to perform her streaming business and is clearly not being used in any other way for clear personal use. It doesn't matter if it is arguably frivolous crap to call a steam library's worth of video games a tax expense, if you can prove you use it for predominately your business then it counts.

I'd imagine the primary issue is that it is you might be able to argue that you can't prove that the game will then never be played again later for non-business use so you can't deduct the full amount and you can't really depreciate a game on Steam as easily as you can a car. The best way you can do depreciation would be across 7 years which is a catch all IRS number for and I quote "Any property that does not have a class life and has not been designated by law as being in any other class."

If the whole "we don't know if we can just use play time" metric is the issue, then you'd probably do something like 80% of year 1, X% year 2, etc etc or something though this begs the question how you count this when you aren't play it at all. Also you can deduct internet, electricity, and pretty much all utilities involved in streaming, so I don't buy that Kiara doesn't have deductions as her internet is a very big one. Her tax accountant is either lazy/dumb, or Kiara just doesn't understand what's going on.

I don't believe you need to pay taxes to both countries either, their are ways to work around that and I know in cases like American and EU taxes you never pay twice on income made across two countries. You'd have to do a lot of work to figure this out, but you can make your income up to a percentage count only for the country it was earned. I'd presume that would be based on where she streamed that particular day or what not. I remember someone in the comments of that one Calli clip argued that Calli's tax accountant might actually be ripping her off because Calli is tax illiterate and may not even see her tax return beyond signing it, and it is possible to just pocket the money if you're a shady enough fuck. Calli's taxes are probably fairly dense so it'd be easy to hide the numbers around if you can pocket hundreds or even thousands of dollars depending on who does her taxes.

My tax sperging aside, Magni's comment section on his latest Sanic stream is full of people concern fagging because of his medical issues that he was trying to keep under wraps to his fans and management as he didn't tell anyone that he had covid until he already recovered. You got some fags like this feeling BETRAYED by the secret coof our lord Mag had. Someone even wrote a fucking essay longer then my tax sperging about this, they need to take the meds they actually have.

Based Magni didn't give a fuck about covid and just streamed anyway, good job furlord.

She even complained in the past about her tax-person, but she changed and she is apparently much happier now with the work they do.

I might have misunderstood, but does that mean she has to spend more than 1000 euro on games a year to be eligible for a write-off? In that case yeah, its not about the tax-person being incompetent, its just laws not working in her favor.>to the IRS.

In austria write offs for business expenses are called "Werbungskosten" ( translates to advertising cost, don't ask me why it is named that).You are trying to argue that games would in Austria fall under the work tools category for "werbungskosten". For that she would have to proof that they are used mostly for work and not private use, and "mostly" is defined as a minimum 90% ( and not over 50% as you suggest)

Edit 1 to clarify how "werbungskosten" work exactly:

The austrian department of finance has defined a bunch of nonsense as potential business expenses that you can write of (for example, your travel expenses, your car, work clothes, work tools etc etc. Each year the department of finance will assume that you already had to pay 1000€ for business expenses which they will deduct from your taxes ( this year 2022 its 1200€ because of tax cuts). So for Kiara to get write offs on her games she would have to have eligible business expenses of over 1k and proof that she used them mostly for work (again in austria that is a min 90%).

For Soras 5th anniversary and 1 million milestone, her fans put together a introductory video about her and its pretty cute and heartwarming

Empty_Inbox

🏆 Thread Recap links are in my Profile Posts

Early Adopter

Deranged Archivist

Joined:

Sep 13, 2022

Tenma was live on Twitch, playing Celeste.

Calli is planning something

Calli is planning something

Last edited:

- Status

- Not open for further replies.

Similar threads

- Replies

- 20K

- Views

- 2M

- Replies

- 6K

- Views

- 413K

- Replies

- 20K

- Views

- 2M

- Replies

- 652

- Views

- 52K

- Locked

- Replies

- 40K

- Views

- 1M